Applying for Financial Aid

The university uses a standard student budget called a Cost of Attendance (COA) when offering federal and campus-based financial aid awards. The COA is not the tuition/fees bill; it is the total estimated amount it will cost you to attend each year or term based on averages. It includes billed (direct) and non-billed (indirect) costs. actual indirect costs may differ from student to student. The COA includes tuition and fees, room and board, allowances for books, supplies, transportation, loan fees, and, if applicable, dependent care. The law school determines grant and scholarship offers independently from the main campus and notifies recipients directly. Grant and scholarship awards made by the law school are typically assimilated into the federal student aid offer and result in a package combining the federal student loans, grants and scholarships (gift aid). Graduate PLUS Loan or private student loan eligibility is generally the difference between the standard student budget and gift aid. Visit the “How To Apply” portion of our website for more information.

Eligibility for most gift aid awards is determined prior to your first year. Awards are typically automatically renewed up to a total of three years (six semesters) provided that you maintain full-time enrollment. Waiving the need to apply each year allows students to create a financial plan for all three years of the JD program. While initial eligibility for need-based aid is subject to verification, summer earnings have no impact on awards.

That said, continuing students have the opportunity to submit the Continuing Student scholarship application in the summers after 1L and 2L years. You are also encouraged to submit applications for external (outside) scholarships prior to your 1L year and throughout your studies at Berkeley Law.

No. Estimated living expenses in the student budget, i.e. Cost of Attendance, will still be based on the costs associated with living in the Berkeley area. Likewise, federal student loans are typically offered up to the COA minus other aid.

Entering Students:

- You are required to complete the FAFSA for federal student loan and work-study eligibility. Berkeley Law does not require parent information on the FAFSA.

Continuing Students:

- You are required to complete the FAFSA for federal student loan and work-study eligibility. If you are applying for Continuing Student Scholarships, it is strongly recommended that you complete the FAFSA.

This can vary from student to student and is based on how a few questions are answered throughout the Supplemental Gift Aid survey (SGA). There will be an area on the survey where you can further explain your situation if your answers/survey does not accurately reflect your financial situation. (NOTE: the FAFSA uses different criteria to define ‘independent’, therefore, you may not be required to enter parent information on the FAFSA but will be required to on the SGA.

Entering Student Scholarships & Gift Aid webpage: After you are admitted we encourage you to submit the supplemental gift aid application (SGA) within one month. You can expect to receive an email with instructions on how to submit this supplemental gift aid application. This form will primarily ask about financial obstacles you’ve faced or are facing, which can then be taken into consideration when determining your gift aid offer. Applying early means you have a better chance of receiving gift aid, especially for funding that has a financial need component. While the supplemental gift aid application is optional, there are questions on this application that are independent of financial need and background. We therefore encourage all admitted students to submit the SGA. If you choose not to submit the SGA, the information contained in your admissions application will still be used to determine a gift aid offer, therefore it is not required.

Information about gift aid (grants, scholarships, fellowships) can be found here: https://www.law.berkeley.edu/admissions/jd/financial-aid/types-of-aid/scholarships/entering-student-scholarships/

For further information, login to the Admitted Students webpage with your CalNet ID and passphrase: https://www.law.berkeley.edu/admitted-students-jd/apply-for-a-scholarship/

Disbursement and Refund

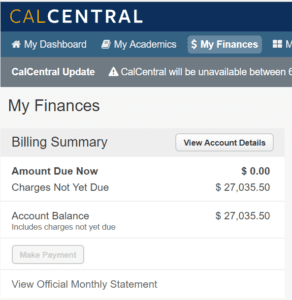

Financial aid is set to disburse no earlier than 10 days before the beginning of each semester. To check if your aid has disbursed click on “My Finances” then “View Transactions”.

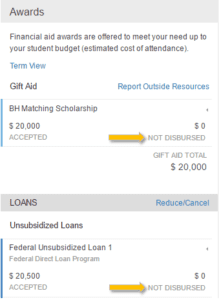

Or, click on “My Finances” and “View Awards”. On the right-hand side you will be able to see the “Awards” and “Loans” sections. Here you can see the status of your financial aid at the bottom right of each award/loan. Awards that have disbursed will show as “DISBURSED” and awards that have not will show as “NOT DISBURSED”. When fall aid disburses, this will show as “PARTIALLY PAID”:

Financial aid is anticipated to begin disbursing 10 days before the start of instruction and before the bill due date for each semester. Your accepted financial aid will electronically disburse towards your tuition and fees bill first. Once your bill is at a zero balance, any excess funds will be returned to you in the form of a refund. The fastest way to receive a refund is by making sure Direct Deposit is set up at least two weeks in advance. Visit the Student Billing website for more information.

If your financial aid payments exceed your charges, the extra funds may be issued to you as a refund, typically by the first week of instruction. The actual timing of your refund depends on when your financial aid was applied to your account. Check CalCentral to monitor your aid payment dates so that you can estimate the date of any expected refund. You will get an email letting you know when your refund is available either via Electronic Funds Transfer (EFT) or as a paper check available for pickup at Cal Student Central. We strongly encourage Berkeley Law students to enroll in EFT if possible to avoid waiting in long lines at the beginning of the semester. Note: UC Berkeley does not require that students open an account with any financial institution. Students may choose to receive credit balances, or refunds, through any banking institution of their choice or via a paper refund check.

Cost of Attendance and Fees

The standard student budget accounts for direct and estimated indirect expenses for the 9-month academic year. The Cost of Attendance does not include expenses for periods of non-enrollment, such as summer. Professional LL.M. students should contact us for information specific to the PLLM program. A student’s financial aid package (made up of a combination of federal student loans, gift aid, outside scholarships, private loans, fee remissions, etc.) cannot exceed the COA.

The most updated official fee schedules for the current year are published on Berkeley’s Fee Schedule page here: https://registrar.berkeley.edu/tuition-fees-residency/tuition-fees/fee-schedule

Expenses may be taken into consideration to increase a student’s estimated COA, such as child care, computer expenses, uninsured medical costs, and relocation expenses (for entering students) for example. These adjustments to the standard student budget are reviewed and approved on a case-by-case basis. The Berkeley Law Cost of Attendance Adjustment Request process is on our Forms webpage and opens sometime in September of each academic year. If approved, typically this would result in an additional Graduate PLUS Loan offer, if eligible.

To view your bill details, log in to CalCentral, go to the “My Finances” tab, and click on “Details” next to the “Billing Summary” box.

Your first e-Bill for the semester will be available approximately one month before instruction begins on CalCentral if enrolled. If eligible for financial aid, please note that this statement may not show your anticipated financial aid, including loan disbursements, for the semester. The Financial Aid and Scholarships Office will begin disbursingfinancial aid about 10 days before instruction begins, as long as you meet eligibility requirements. Eligibility requirements include but are not limited to, being enrolled at least half-time, and not having any registration blocks, tasks, or holds. Payments can be made via CalCentral directly to your balance.

The Fee Payment Plan (FPP) is available to students who do not have enough financial aid to cover fees and tuition by the deadline, or will not be using financial aid to cover the bill. Students may make five equal monthly installments during the semester for a fee.

Borrowing Loans

Log in to CalCentral. Click on “My Finances” and “View Awards.” To accept any amount of your loans, click on “Accept”. Then, you will have the opportunity to indicate how much you’d like to accept for the year. Accepted loans will be disbursed evenly between the fall and spring semesters. Be sure to consider the origination fees (processing fee) for federal loans in your calculations. Processing of the Graduate PLUS Loan, including the credit check, typically occurs in early August.

If not approved for the Graduate PLUS loan due to adverse credit history, you will be notified by the Federal Student Aid. You will have the option of seeking an endorser or appealing the credit check decision.

Loan processing typically begins four weeks before classes begin each semester. To receive a Federal Direct Graduate PLUS Loan, you must be a graduate or professional student enrolled at least half-time (6 credit hours) at an eligible school in a program leading to a graduate or professional degree or certificate, not have an adverse credit history; and meet the general eligibility requirements for federal student aid.

For purposes of qualifying for a Direct PLUS Loan*, you’re considered to have an adverse credit history if:

You have one or more debts with a total combined outstanding balance greater than $2,085 that are 90 or more days delinquent as of the date of the credit report, or that have been placed in collection or charged off (written off) during the two years preceding the date of the credit report; or

- During the five years preceding the date of the credit report, you have been subject to a

- default determination,

- discharge of debts in bankruptcy,

- foreclosure,

- repossession,

- tax lien,

- wage garnishment, or

- write-off of a federal student aid debt.

*The information above is accurate for Direct PLUS Loan credit checks performed on or after March 29, 2015.

You have the option to cancel all or part of any disbursement of a Federal Direct Loan without being charged interest or other loan fees as long as the cancellation is processed within 120 days of your loan’s original disbursement date. Please note that if you cancel a loan that has already disbursed, a charge will be applied to your account within approximately 2 to 3 business days and will create a balance due. You are responsible for paying this balance so that Berkeley can return the funds to the lender. If you are looking to return loan amounts that have been given to you as a financial aid refund and you have not authorized Direct Deposit then your refund will be mailed to you as a check. Please do not return the check to Berkeley or send a payment to your servicer if you cancel your loan. Be prepared to send your payment to your bill.

If it has been more than 120 days since the loan you are looking to cancel has disbursed, you cannot cancel the loan. However, you can make a payment to your servicer. Locate the servicer’s contact information by logging into your federal student loan account at studentaid.gov.

To reduce/cancel a loan please complete the Berkeley Law Loan Modification Request Form. If this link is not available to you, please email the financial aid office.

You’re encouraged to accept the smallest amount of federal student loans needed for the year. You can accept less than the offered amount, which is your maximum eligibility. If you accept less than the maximum amount offered to you, you have until the end of the term or year to accept additional amounts of the loan. Feel free to use the following calculator to determine net loan amount after origination fees are deducted:

Please keep in mind that the calculator uses origination fees based on the current year’s rate. Origination fees change annually on October 1st.

Refer to the federal student aid website for current origination fees

All interest rates for federal student loans are fixed rates for the life of the loan. The interest rate varies depending on the loan type and (for most types of federal student loans) the first disbursement date of the loan. Interest rates on federal student loans are set by Congress. View current interest rates and origination fees on the Federal Student Aid website.

Yes, if you meet all eligibility criteria, you can accept loans throughout the academic year. Professional LL.M. students should contact us for additional information.

You’re encouraged to accept the smallest amount of loans needed for the year. You can accept less than the offered amount, which is your maximum eligibility. If you accept less than the maximum amount offered, you have until the end of the term or year to accept additional amounts of the loan, which will be automatically offered. If your additional eligibility is not automatically offered, please email the Financial Aid Office. Please plan on accepting any additional loans at least four weeks before the end of a semester for timely processing. If you are accepting additional loans during the spring semester, please keep in mind that your loan period expires at the end of the academic year, and we recommend accepting at least four weeks prior to the end of the spring semester. Login to CalCentral to accept loans. If you’ve already completed Entrance Counseling as well as the Master Promissory Note for that loan type, you will not need to complete them again.

Please plan on accepting any additional loans at least four weeks before the end of a semester for timely processing. If you are accepting additional loans during the spring semester, please keep in mind that your loan period with your lender expires at the end of the academic year, and we recommend accepting at least four weeks prior to the end of the spring semester.

No, private loan disbursements are first applied to unpaid charges on your billing account. Once the outstanding charges are paid, the extra funds are then given to you as a financial aid refund.

Interest accrues daily on your student loan from the day it’s disbursed until the day your loan balance reaches zero.

Use this simple formula to calculate your daily interest accrual:

Interest rate × current principal balance ÷ number of days in the year = daily interest

Managing Student Loans

If you do not know what type of federal student loans you borrowed while in attendance at UC Berkeley, visit the Federal Student Aid website. To verify any lines of credit that you have, including private student loans, request a copy of your free annual credit report.

If you plan on borrowing federal student loans, it’s a good idea to become familiar with the different repayment options you have. There are three useful loan payment calculators that can help you estimate what repayment will look like:

- The Federal Student Aid loan simulator allows you to compare all the federal repayment plans, like the Standard 10-year plan and the Income-Driven Repayment plans.

- This loan payoff calculator allows you to see how long it’ll take to pay off your loans if you pay $XX amount per month, or what you should pay per month if you want to pay off your loans in XX years.

- This loan amortization calculator allows you to predict how your loan balance will change each year depending on how much you pay.

Typically your federal loan servicer should receive your fall semester enrollment information in a timely manner through UC Berkeley’s use of the National Student Loan Clearinghouse. This is done automatically for entering students. If you are in repayment and need to send a deferment form to your lender as soon as possible, please download and fill out an In-School Deferment Form from your lender’s website. You will need to send your In-School Deferment Form to your lender by uploading it through their website, faxing, or mailing. Before you can return your form, you will need a Financial Aid Officer at Berkeley Law to certify it.

Before leaving school (transferring, withdrawing, canceling, taking a semester off, or graduating), be sure to complete your Exit Counseling. Keep in touch with your loan servicer. Once you leave school for any reason, your 6-month grace period begins. If you do not re-enroll before 6 months, you will enter repayment. Toward the end of your 6-month grace period, you should receive information about beginning repayment. If you do not, contact the servicer(s) of your loans immediately and confirm that they have your correct contact number and last date of attendance. You begin repaying your loans after the 6-month grace period has passed.

Yes. J.D. students considering public service careers are encouraged to discuss their options with a Berkeley Law LRAP Advisor well before graduation. If you are considering applying to Public Service Loan Forgiveness (PSLF) or participating in the LRAP Program, it’s highly encouraged to schedule an appointment, particularly in your 3L year (but you can meet with us at any time!). In order to participate in LRAP, you must meet with an LRAP advisor prior to graduation.

Refinancing your federal student loans is the process of replacing your federal student debt with debt held by a private company. When you refinance, a private lender pays off your existing loan and creates a new private loan with a new interest rate and repayment schedule.

Refinancing makes sense for some borrowers, but not all. If you want to use Berkeley Law’s Loan Repayment Assistance Program (LRAP), federal income-driven repayment, or federal Public Service Loan Forgiveness (PSLF), do not refinance your student loans. Refinancing will make you ineligible for LRAP and you will lose all federal student loan benefits like income-driven repayment, PSLF, and time-based forgiveness. Many other benefits are only applicable to federal student loans, such as the option to put your loans into deferment or forbearance, or the CARES Act temporary 0% interest rate and suspended loan payments. Therefore, it’s crucial to consider what other benefits you may be losing.

If you do not intend to use LRAP, PSLF, income-driven repayment, or any other federal student loan benefits, refinancing might make sense for you to lower your interest rate or pay off your loan on a different schedule. Generally, you’ll want to be able to afford a monthly payment at least equal to the standard 10-year repayment plan before refinancing (use the Federal Student Aid loan simulator to see what your standard 10-year plan looks like). If you can afford that (meaning you have a high and steady income), we recommend exploring the benefits different lenders have to offer. Private lenders can generally offer lower interest rates and varying repayment term options depending on the company, your credit score, your loan balance, and whether you have a co-signer.

Tax Related Information

UC Berkeley files Form 1098-T for each student the university enrolls and for whom a reportable transaction is made. You can learn more about Form 1098-T, by going to UC Berkeley’s Student Billing Services webpage: https://studentbilling.berkeley.edu/loan-services-and-repayment/form-1098-t-tax-benefits.

Various factors determine if an individual is required to file a tax return. Please use this IRS tool to determine if you have to file a tax return: https://www.irs.gov/help/ita/do-i-need-to-file-a-tax-return.

Many students will qualify to file free tax returns. To learn more please visit the Free File section of the IRS website at https://www.irs.gov/filing/free-file-do-your-federal-taxes-for-free.

The Graduate Assembly has past tax workshop presentations which can be viewed at https://ga.berkeley.edu/resources/taxes-support/.

ASUC Student Legal Clinic provides Volunteer Income Tax Assistance Services: https://www.asucslcberkeley.org/appointments.html

Additionally, Berkeley Public Library has Free Tax Preparation and Free Tax Filing Assistance through April 15th. Please visit their website at berkeleypubliclibrary.org/topics/personal-finance-tax.

View the previously recorded VIRTUAL Tax Workshop For Graduate Students

Glossary

Accrued interest The interest that a loan accumulates over time.

Alternative Loan These are private loans that are offered by financial institutions. Some students choose to or need to apply for private loans when the federal loans don’t cover their total educational costs. Interest rates and other policies vary by lender.

Capitalization of interest The process of adding unpaid interest (often at the end of the loan’s grace period) to the principal of the loan. The amount owed increases, and this larger figure, the original principal and unpaid interest, accrues interest itself. It is advisable, if possible, to make interest payments while in school so that capitalization does not occur.

Consolidation Loan Combining several loans from different lenders into one bigger loan from a single lender with the intention to simplify repayment and possibly get a lower interest rate.

Cost of Attendance (COA) The student “budget” determined by the financial aid office, which includes tuition, fees, and living expenses. The cost of attendance is used in calculating financial aid packages.

Cost of Attendance Adjustment Request Formerly known as the budget appeal. This is a process that allows students to ask for adjustments in the amount of financial aid they might be offered by increasing the individual student budget. For example, if a student is paying rent and utilities higher than the average posted on the standard cost of attendance. In most instances, students will be offered additional loans.

Default Failure to repay a loan according to the terms agreed to in the promissory note. Default varies by loan. When in default, the school, lender, and government may all take action to obtain the money owed. In addition, default can affect credit ratings for up to seven years. Default can be avoided by applying for deferment or forbearance before missing a payment.

Deferment (In School) A type of postponement of loan repayment granted to students who are in school and enrolled at least half-time. If you do not qualify for a deferment, you may still be able to get forbearance. Subsidized loans in deferment do not accrue interest, but unsubsidized loans in deferment do.

Deferment (Economic Hardship) A type of postponement of loan repayment granted to borrowers when loan repayment is not possible due to extreme financial hardship. Eligibility for economic hardship deferment is more restricted than forbearance and generally requires that the borrower be receiving some sort of government assistance. If you do not qualify for a deferment, you may still be given forbearance. Subsidized loans in deferment do not accrue interest, but unsubsidized loans do.

Expected family contribution (EFC) The amount of money that the family is expected to contribute to the student’s education as calculated by applying a formula to information submitted on the FAFSA. EFC consists of parent and student contributions, which are determined based on the student’s dependency status, family size, number of family members in school, and taxable and nontaxable income and assets. Note that the criteria for student dependency for FAFSA are NOT the same as the criteria for dependency for need-based aid at Berkeley Law.

Exit Counseling This is an opportunity to remind yourself of your rights and responsibilities as a student loan borrower. In turn, you must provide your lender with certain information about your plans after you leave school (for example, your current address, your expected employer, two personal references, etc.). If you graduate, withdraw or drop below half-time registration status, and you have borrowed a Federal Direct, Health Professions, or Perkins loan, you must complete the Exit Loan Counseling requirement. Completing the Exit requirement is only one step in keeping your loans in good standing. Remember that student loan indebtedness is reported to credit agencies. Until your loan is paid in full, you should continue to communicate with your lender regarding any changes in your address, school enrollment status or questions about making repayment.

Direct Deposit This is a safe and quick way to have your financial aid deposited directly into your savings or checking account. After your financial aid is applied to your balance in your account, if there is money remaining, you receive it as a “refund.” If you sign up for Direct Deposit you’ll have access to your refund quickly. If you choose not to sign up for Direct Deposit and you are eligible for a refund you will be issued a check that you must pick up from the Billing an Payment Services Office in University Hall. They do not mail checks.

Federal Direct Student Loan Program The full name is William D. Ford Federal Direct Loan Program. The Direct Loan Program is offered by the Department of Education, and it provides students with a simple, inexpensive way to borrow money to pay for education after high school.

Financial Aid Refund If your financial aid payments exceed your charges, the extra funds may be issued to you as a refund, typically by the first week of instruction. The actual timing of your refund depends on when your financial aid was applied to your account.

Food Assistance Program UC Berkeley strives to ensure that all students have access to nutritious food. Currently enrolled students may be eligible for Cal 1 Card dollars or other food assistance.

Forbearance A type of postponement of loan repayment. The borrower does not need to pay the principal during the forbearance period, but interest continues to accrue and must be paid, even on subsidized loans. Forbearances are usually granted by the lender in cases of financial hardship or other unusual circumstances when the borrower does not qualify for deferment.

Gift Aid: Financial aid, such as grants and scholarships, which does not need to be repaid.

Income-Driven Repayment Most federal student loans are eligible for at least one income-driven repayment plan. If your income is low enough, your payment could be as low as $0 per month.

Origination fee Most federal student loans have loan fees that are a percentage of the total loan amount. The loan fee is deducted proportionately from each loan disbursement you receive. This means the money you receive will be less than the amount you actually borrow. You’re responsible for repaying the entire amount you borrowed and not just the amount you received.

Outside Resource Any type of financial assistance that you are receiving from a donor outside of the University. Outside scholarships, prepaid tuition plans, and VA educational benefits are examples of outside resources.

Overaward An overaward may exist when the student’s need-based aid exceeds the student’s financial need, the student’s total financial aid awards exceed the cost of attendance or both. In some but not all cases, financial aid will be reduced to resolve the overaward.

Private loans Education loans from private lenders that are typically used to supplement the education loans offered by the federal government.

Public Service Loan Forgiveness Program (PSLF) Under PSLF, full-time public service employees may qualify for forgiveness of the balance of their loan after 120 on-time monthly payments (10 years). PSLF only applies to federal loans made through the Direct loan program (Subsidized and Unsubsidized Stafford Loans, PLUS Loans, and Consolidation Loans).

Subsidized Loan The federal government pays the interest on subsidized loans, such as Subsidized Stafford Loans and Perkins Loans, while the student is in school. As of July 2012, the subsidized loan is no longer available to graduate-level (including law) students.

Unsubsidized Student Loan Students who have unsubsidized loans are charged interest on the loan as soon as the loan is disbursed. Although students do not have to make payments while they are enrolled at least half-time in college, interest is being charged on the loan. All PLUS loans are unsubsidized.

Work-Study The Federal Work-Study program provides undergraduate and graduate students with part-time employment during the school year. The federal government pays a portion of the student’s salary, making it cheaper for departments and businesses to hire the student. For this reason, work-study students often find it easier to get a part-time job. Eligibility for Federal Work-Study is based on need.