How can I tell what financial aid I’ve received?

How do I know if I have any Tasks I need to complete?

How do I know if I have a Hold on my account?

Can I reduce or cancel a loan that I’ve accepted?

What happens to my federal loans after I graduate or leave school?

How do I defer my student loan payments while attending Berkeley Law?

How do I know what student loans I’ve borrowed?

How can I estimate what my monthly student loan payments will be after graduation?

How does interest accrue on Federal student loans?

Glossary of Financial Aid Terms

How can I tell what financial aid I’ve received?

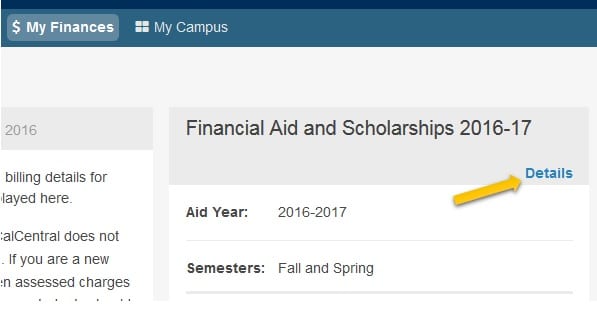

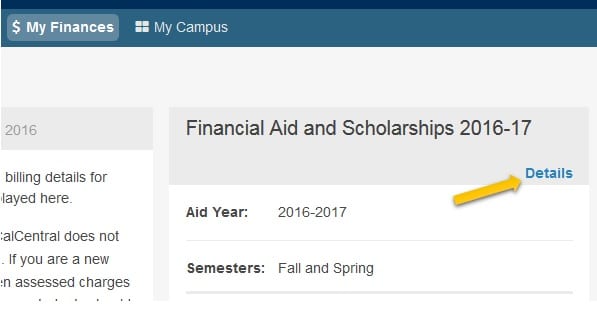

Financial aid is set to disburse around August 16th for the fall 2018 semester. To check if your aid has disbursed click on “Details” under the “Financial Aid and Scholarships 2018-19” box:

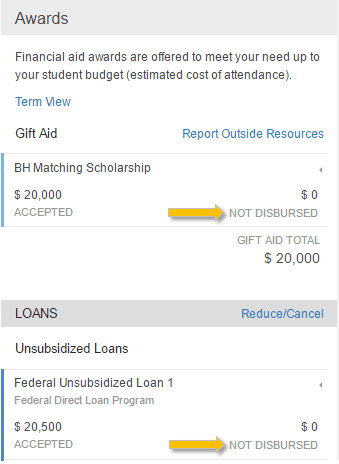

At the right-hand side you will be able to see the “Awards” and “Loans” sections. Here you can see the status of your financial aid at the bottom right of each award/loan. Awards that have disbursed will show as “DISBURSED” and awards that have not will show as “NOT DISBURSED”. When fall aid disburses, this will show as “PARTIALLY PAID”:

How do I find my Tasks in the Communications section in the My Finances tab?

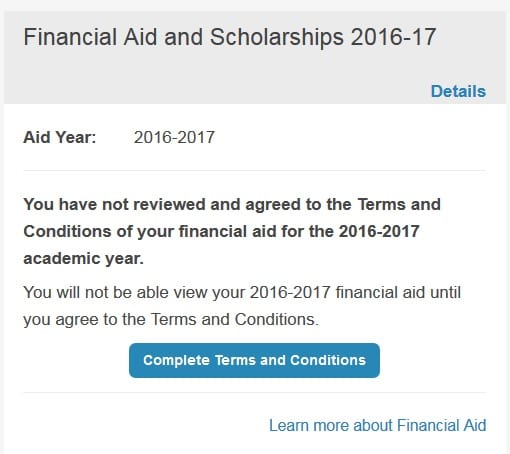

Log into CalCentral. Under the “My Finances” tab, accept your Terms and Conditions if you have not already done so:

Click on “Details” under the “Financial Aid and Scholarships 2016-17” box:

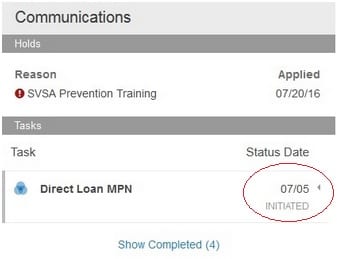

At the bottom left-hand side you will be able to see the “Communications” and “Tasks” sections. Here you can see both completed and uncompleted tasks. Tasks that you need to complete will show as “INITIATED”:

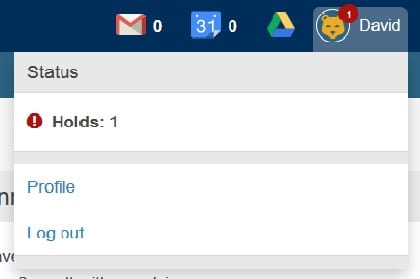

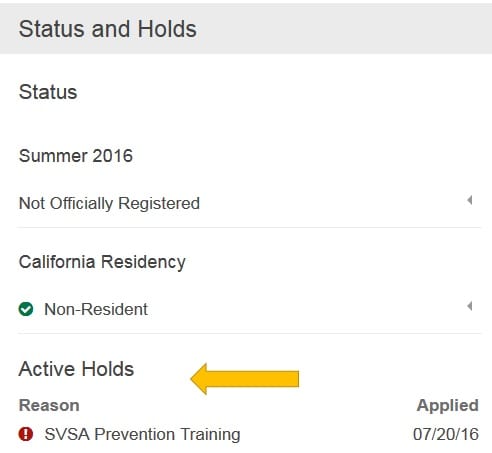

How do I know if I have a Hold on my account?

Certain holds may prevent financial aid disbursement. Any hold that prevents registration may impact financial aid, as you must be enrolled for financial aid to disburse and to receive a refund. Holds can be viewed on CalCentral:

The “applied” date corresponds to when the hold was put on your account.

What are the current interest rates and origination fees for Federal Unsubsidized and Grad PLUS loans?

All interest rates for federal student loans are fixed rates for the life of the loan. The interest rate varies depending on the loan type and (for most types of federal student loans) the first disbursement date of the loan. Interest rates on federal student loans are set by Congress. View current interest rates and origination fees on the Federal Student Aid website.

Can I reduce or cancel a loan that I’ve accepted?

You have the right to cancel all or part of any disbursement of a Federal Direct Loan without being charged interest or other loan fees as long as the cancellation is processed within 120 days of your loan’s original disbursement date. Please note that if you cancel or reduce a loan that has already disbursed, a charge will be applied to your account within approximately 2 to 3 business days and will create a balance due. You are responsible for paying this balance so that Berkeley can return the funds to the lender. If you are looking to cancel loan amounts that have been given to you as a financial aid refund and you have not authorized Direct Deposit then your refund will be mailed to you as a check. Please do not return the check to Berkeley or send a payment to your servicer if you cancel your loan. Be prepared to send your payment to your bill.

If it has been more than 120 days since your loan disbursement date, you cannot cancel your loan. However, you can make a payment to your servicer. Locate the servicer’s contact information by logging into your federal student aid account at studentaid.gov.

What happens to my federal loans after I graduate or leave school?

Before leaving school (transferring, withdrawing, cancelling, taking a semseter off, or graduating), be sure to complete your Exit Counseling. Keep in touch with your loan servicer. Update your loan servicer with any changes to your school attendance or contact information. Once you leave school for any reason, your 6-month grace period begins. If you do not re-enroll before 6 months, you will enter repayment. Toward the end of your 6-month grace period, you should receive information about beginning repayment. If you do not, contact the servicer(s) of your loans immediately and confirm that they have your correct contact number and last date of attendance. You begin repaying your loans after the 6-month grace period has passed.

How do I defer my student loan payments while attending Berkeley Law?

Typically your federal loan servicer should receive your fall semester enrollment information in a timely manner through UC Berkeley’s use of the National Student Loan Clearinghouse. This is done automatically for entering students. If you are in repayment and need to send a deferment form to your lender as soon as possible, please download and fill out an In-School Deferment Form from you lender’s website. You will need to send your In-School Deferment Form to your lender by uploading it through their website, faxing, or mailing. Before you can return your form, you will need a Financial Aid Officer at Berkeley Law to certify it.

I’m planning on participating in Berkeley’s Loan Repayment Assistance Program (LRAP). Is there anything I need to do before I graduate?

Yes. J.D. students considering public service careers are encouraged to discuss their options with a Berkeley Law LRAP Advisor well before graduation. If you are considering applying to Public Service Loan Forgiveness (PSLF) or participating in the LRAP Program, it’s highly encouraged to schedule an appointment before you graduate. In order to participate in the LRAP, you must meet with an LRAP advisor prior to graduation.

How do I know what student loans I’ve borrowed?

If you do not know what type of federal student loans you borrowed while in attendance at UC Berkeley, visit studentaid.gov. To verify any lines of credit that you have, including private student loans, request a copy of your free annual credit report.

How can I estimate what my monthly student loan payments will be after graduation?

If you plan on borrowing federal student loans, it’s a good idea to become familiar with the different repayment options you have. To make your payments more affordable, repayment plans can give you more time to repay your loans or can be based on your income. Use the Department of Education’s Repayment Estimator. On this site, you can either ‘log in’ to view your actual federal student loans, or you can ‘proceed’ to manually enter in estimated loan balances. If you will be using Berkeley’s LRAP program, we strongly encourage you to speak with an LRAP advisor for more information.

How do I know what student loans I’ve borrowed?

Interest accrues daily on your student loan from the day it’s disbursed until the day your loan balance reaches zero.

Use this simple formula to calculate your daily interest accrual:

Interest rate × current principal balance ÷ number of days in the year = daily interest

source: https://myfedloan.org/help-center/faq/interest-faq.shtml