What is the process of applying for financial aid?

When does financial aid disburse?

Financial Aid Refunds – What is the process to apply/receive?

How do I accept just a portion of the loans that I’m offered?

Do I have to report private outside scholarships that I’ll be receiving?

What are my options if I’m not approved for the Graduate PLUS Loan?

How do I pay my fees and tuition?

How much should I accept in loans to account for the origination fee?

If I don’t borrow loans the first semester, can I borrow loans in the second semester?

Can I reduce or cancel a loan that I’ve accepted?

How is my financial aid eligibility determined?

How do I find the Estimated Cost of Attendance (COA)?

What happens to my federal loans after I graduate or leave school?

My Cost of Attendance (COA) is not reflective of my actual expenses. What should I do?

What other outside scholarship opportunities can I apply for?

How do I defer my student loan payments while attending Berkeley Law?

How do I know what student loans I’ve borrowed?

What are the policies for students withdrawing?

How can I estimate what my monthly student loan payments will be after graduation?

How does interest accrue on Federal student loans?

Am I required to provide my parent’s information when applying for need-based financial aid?

Am I required to complete both the FAFSA and the Supplemental Gift Aid (SGA) survey?

What aid is available for International students?

Can DACA students who are eligible to complete a DREAM Act application be considered for work study?

Glossary of Financial Aid Terms

What is the process of applying for financial aid?

Please view our Entering Student Checklist for important timeframes and an outlined process on how to apply for student loans and gift aid. UC Berkeley Law School does not utilize the CSS Profile. Financial hardships may be reported on the Supplemental Gift Aid (SGA) application once a student is admitted to Berkeley Law.

When does financial aid disburse?

Financial aid is anticipated to begin disbursing by the first week of classes and before the bill due date for each semester.

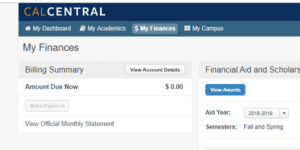

Viewing your disbursements in CalCentral:

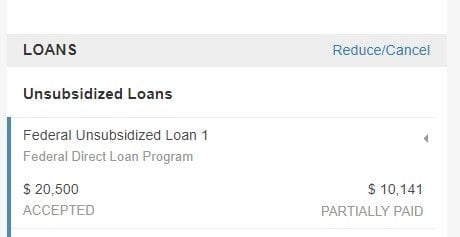

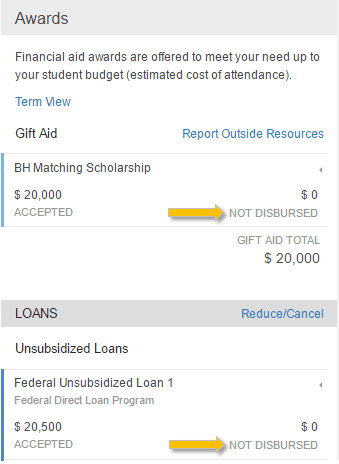

At the right-hand side you will be able to see the “Awards” and “Loans” sections. Here you can see the status of your financial aid at the bottom right of each award/loan. Awards that have disbursed will show as “DISBURSED” and awards that have not will show as “NOT DISBURSED”. When fall aid disburses, this will show as “PARTIALLY PAID”:

Financial Aid Refunds – What is the process to apply/receive?

Financial aid is anticipated to begin disbursing by the first week of classes and before the bill due date for each semester. Your accepted financial aid will electronically disburse towards your tuition and fees bill first. Once your bill is at a zero balance, any excess funds will be returned to you in the form of a refund. The fastest way to receive a refund is by making sure Direct Deposit is set up up to at least two weeks in advance. See more information here.

How do I accept just a portion of the loans that I’m offered?

Login to CalCentral and click on “My Finances” then “View Awards.” To accept any amount of your loans, click on “Accept”. Then, you will have the opportunity to indicate how much you’d like to accept for the year. Accepted loans will be disbursed evenly between fall and spring semester. Be sure to consider the origination fees (processing fee) for federal loans in your calculations. Processing of the Graduate PLUS Loan, including the credit check, typically occurs in early August. Results after the credit check are delivered to the student via email.

Do I have to report private outside scholarships that I’ll be receiving?

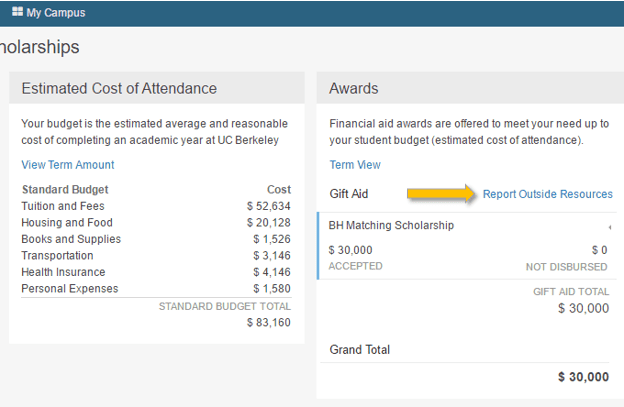

Yes. To report private outside agency scholarships on CalCentral click on “Details” under the “Financial Aid and Scholarships” box:

Then click on “Report Outside Resources” under the “Awards” box:

It is important to do this early because your financial aid, typically the Graduate PLUS Loan, may be reduced to ensure that the amount of your financial aid resources doesn’t exceed your Cost of Attendance. More information about how and where to mail scholarship checks can be found here. If unable to report private scholarships on CalCentral, email us to notify us of your award and to discuss impacts to your financial aid.

What are my options if I’m not approved for the Graduate PLUS Loan?

If not approved for the Graduate PLUS loan due to adverse credit history, you will be notified by Direct Loans after Berkeley begins loan processing and you will have the option of seeking an endorser. Click here for more information on seeking an endorser. Loan processing typically begins four weeks before classes begin each semester. To receive a Federal Direct Graduate PLUS Loan, you must be a graduate or professional student enrolled at least half-time at an eligible school in a program leading to a graduate or professional degree or certificate, not have an adverse credit history; and meet the general eligibility requirements for federal student aid.

For purposes of qualifying for a Direct PLUS Loan*, you’re considered to have an adverse credit history if

• you have one or more debts with a total combined outstanding balance greater than $2,085 that are 90 or more days delinquent as of the date of the credit report, or that have been placed in collection or charged off (written off) during the two years preceding the date of the credit report; or

• during the five years preceding the date of the credit report, you have been subject to a

o default determination,

o discharge of debts in bankruptcy,

o foreclosure,

o repossession,

o tax lien,

o wage garnishment, or

o write-off of a federal student aid debt.

*The information above is accurate for Direct PLUS Loan credit checks performed on or after March 29, 2015.

How do I view my bill details?

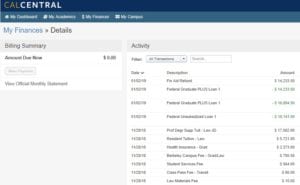

To view your bill details go to the “My Finances” tab and click on “View Account Details”

Filter, and select “All Transactions”.

If financial aid has been applied to your bill, then you will see it in green font. If your financial aid has covered all charges on your account and there is still an amount left over, then this amount will be given to you in the form of a financial aid refund and you will be able to see this on the same page, listed as a “Refund”.

**This image corresponds to the 2015-16 academic year**

How do I pay my fees and tuition?

Your first e-Bill for the semester will be available approximately one month before instruction begins on CalCentral if enrolled. If eligible for financial aid, please note that this statement may not show your anticipated financial aid, including loan disbursements, for the semester. The Financial Aid and Scholarships Office will begin applying financial aid about 10 days before instruction begins, as long as you meet eligibility requirements. Eligibility requirements include, but are not limited to, being enrolled at least half-time, not having any registration blocks, tasks, or holds. Payments can be made via CalCentral directly to your balance. Please click here for more information.

What is the Fee Payment Plan?

The Fee Payment Plan (FPP) is available to students who do not have enough financial aid to cover fees and tuition by the deadline, or will not be using financial aid to cover the bill. Students may make five equal monthly installments during the semester for a fee.

How much should I accept in loans to account for the origination fee?

You’re encouraged to accept the smallest amount of federal student loans needed for the year. You can accept less than the offered amount, which is your maximum eligibility. If you accept less than the maximum amount offered to you, you have until the end of the term or year to accept additional amounts of the loan. Feel free to use the following examples as guides:

Example 1: Student needs enough to cover tuition and fees. She will be waiving the SHIP health insurance and paying for indirect expenses out of pocket. Her total university charges are estimated at $26,000 per semester.*

She has been offered the following:

| Academic Year* | Fall | Spring | Origination Fee** | |

| Federal Unsubsidized Stafford Loan | $20,500 | $10,250 | $10,250 | 1.068% |

| Federal Graduate PLUS Loan | $60,000 | $30,000 | $30,000 | 4.272% |

- She decides to accept the full amount of the Federal Unsubsidized Stafford Loan of $20,500. The origination fee of $110.00 is deducted from the loan before the funds apply to her charges ($10,250 x .01068 = $110.00 origination fee per semester). The net amount disbursed per semester is therefore $10,140.00.

- After the Unsubsidized Stafford loan disburses, she has has a remaining semester balance of $15,860.00.

- She decides to accept the Graduate PLUS Loan to cover the remaining balance of $15,860.00 per semester, or $31,720 per year. She uses the following method to calculate how much she needs to accept: $31,720 ÷ (1 – 0.04272) = $33,136. She therefore accepts ~$33,136 in the Graduate PLUS Loan ($33,136 x .04272 = $1,415 –> $31,720 + $1,416 = $33,136) for the year.

*Amounts are solely for demonstration purposes. Refer to your estimated Cost of Attendance or bill on CalCentral to view costs and awards.

**Refer to the federal student aid website for current origination fees

Example 2: Student needs enough to cover direct expenses like tuition, fees, and SHIP health insurance. Additionally, he’s determined he needs $20,000 in a refund for room/board and living expenses for the academic year. His total university charges are estimated $27,500 per semester.*

He has been offered the following:

| Academic Year* | Fall | Spring | Origination Fee** | |

| Gift Aid (Grant/Scholarship) | $10,000 | $5,000 | $5,000 | n/a |

| Federal Unsubsidized Stafford Loan | $20,500 | $10,250 | $10,250 | 1.068% |

| Federal Graduate PLUS Loan | $50,000 | $25,000 | $25,000 | 4.272% |

- After his gift aid disburses, his remaining balance per semester is $22,500 ($27,500 – $5,000 scholarship). He decides to accept the full amount of the Federal Unsubsidized Stafford Loan of $10,250 per semester. The origination fee of $110.00 is deducted from the loan before the funds apply to his charges ($10,250 x .01068 = $110.00 origination fee per semester). The net amount disbursed is therefore $10,140.00.

- His remaining semester balance comes to $12,360.00 after his scholarship and Unsubsidized Stafford loan are applied ($27,500 – $5,000 – $10,140.00 = $12,360.00)

- He decides to accept the Graduate PLUS Loan to cover his remaining balance plus an additional $10,000 to cover his living expenses for a total of $22,360 per semester. After accounting for the 4.272% origination fee, he decides to accept $23,358 in the Graduate PLUS Loan ($22,360 ÷ (1 – 0.04272) = $23,358) for the semester, or $46,716 per year.

- After his aid is applied to his charges, he can expect a $10,000 refund for the semester to use for living expenses.

*Amounts are solely for demonstration purposes. Refer to your estimated Cost of Attendance or bill on CalCentral to view costs and awards.

**Refer to the federal student aid website for current origination fees

What are the current interest rates and origination fees for Federal Unsubsidized and Grad PLUS loans?

All interest rates for federal student loans are fixed rates for the life of the loan. The interest rate varies depending on the loan type and (for most types of federal student loans) the first disbursement date of the loan. Interest rates on federal student loans are set by Congress. View current interest rates and origination fees on the Federal Student Aid website.

If I don’t borrow loans the first semester, can I borrow loans in the second semester?

Yes, if you meet all eligibility criteria, you can accept loans throughout the academic year. Professional LL.M. students should contact us for additional information.

If I don’t accept the maximum amount of loans I’ve been offered, how do I accept additional amounts later?

You’re encouraged to accept the smallest amount of loans needed for the year. You can accept less than the offered amount, which is your maximum eligibility. If you accept less than the maximum amount offered, you have until the end of the term or year to accept additional amounts of the loan, which will be automatically offered. Login to CalCentral to accept loans. If you’ve already completed Entrance Counseling as well as the Master Promissory Note for that loan type, you will not need to complete them again.

Can I reduce or cancel a loan that I’ve accepted?

You have the right to cancel all or part of any disbursement of a Federal Direct Loan without being charged interest or other loan fees as long as the cancellation is processed within 120 days of your loan’s original disbursement date. Please note that if you cancel or reduce a loan that has already disbursed, a charge will be applied to your account within approximately 2 to 3 business days and will create a balance due. You are responsible for paying this balance so that Berkeley can return the funds to the lender.

If it has been more than 120 days since your loan disbursement date, you cannot cancel your loan. However, you can make a payment to your servicer. Locate the servicer’s contact information by logging into your federal student loan account at studentaid.gov.

Reduce/Cancel link can be found under My Finances -> Details

If this link is not available to you, please email the Berkeley Law Financial Aid Office.

How is my financial aid eligibility determined?

The university uses a standard student budget called a Cost of Attendance (COA) when offering federal and campus-based financial aid awards. The COA is not the bill that you may get; it is the total estimated amount it will cost you to attend each year or term. The COA includes tuition and fees, room and board, allowances for books, supplies, transportation, loan fees, and, if applicable, dependent care. The law school determines grant and scholarship offers independently and notifies recipients directly. Grant and scholarship awards made by the law school are typically assimilated into the federal student aid offer and result in a package combining the federal student loans, campus-based aid, and grants and scholarships. Graduate PLUS Loan or private student loan eligibility is generally the difference between the standard student budget and the financial aid package. Visit the “How To Apply” portion of our website for more information.

How do I find the Estimated Cost of Attendance (COA)?

The standard student budget accounts for direct and estimated indirect expenses for the 9 month academic year. The Cost of Attendance does not include expenses for periods of non-enrollment, such as summer. Professional LL.M. students should contact us for information specific to the PLLM program. Click here for J.D. Cost of Attendance information. A student’s financial aid package (made up of a combination of federal student loans, gift aid, outside scholarships, private loans, fee remissions, etc.) cannot exceed the COA.

What happens to my federal loans after I graduate or leave school?

Before leaving school (transferring, withdrawing, cancelling, taking a semseter off, or graduating), be sure to complete your Exit Counseling. Keep in touch with your loan servicer. Update your loan servicer with any changes to your school attendance or contact information. Once you leave school for any reason, your 6-month grace period begins. If you do not re-enroll before 6 months, you will enter repayment. Toward the end of your 6-month grace period, you should receive information about beginning repayment. If you do not, contact the servicer(s) of your loans immediately and confirm that they have your correct contact number and last date of attendance. You begin repaying your loans after the 6-month grace period has passed.

My Cost of Attendance (COA) is not reflective of my actual expenses. What should I do?

Expenses may be taken into consideration to increase a student’s estimated COA, such as child care, computer expenses, uninsured medical costs, and relocation expenses (for entering students) for example. These adjustments to the standard student budget are reviewed and approved on a case-by-case basis. The Berkeley Law Cost of Attendance Adjustment Request process is on our Forms webpage and opens sometime in September of each academic year. If approved, typically this would result in an additional Graduate PLUS Loan offer, if eligible.

If I take out a private educational loan while at Berkeley Law, will the money be paid to me directly?

No, private loan disbursements are first applied to unpaid charges on your billing account. Once the outstanding charges are paid, the extra funds are then given to you as a financial aid refund.

What aid is available for International students?

University policy requires international students to demonstrate the ability to pay their expenses through their first year. Please see our International Students page. Continuing international students may apply for limited student aid funds through the university and should contact the Berkeley International Office at the International House for additional information.

What other outside scholarship opportunities can I apply for?

We make every effort to announce scholarships offered by outside agencies which may be of interest to our students, especially scholarships that are $10,000 or more. These scholarships have their own applications, procedures, criteria, and deadlines. While our Outside Agency Scholarship page is a good starting point, we encourage you to seek out your own scholarships as well.

How do I defer my student loan payments while attending Berkeley Law?

Typically your federal loan servicer should receive your fall semester enrollment information in a timely manner through UC Berkeley’s use of the National Student Loan Clearinghouse. This is done automatically for entering students. If you are in repayment and need to send a deferment form to your lender as soon as possible, please download and fill out an In-School Deferment Form from you lender’s website. You will need to send your In-School Deferment Form to your lender by uploading it through their website, faxing, or mailing. Before you can return your form, you will need a Financial Aid Officer at Berkeley Law to certify it.

I’m planning on participating in Berkeley’s Loan Repayment Assistance Program (LRAP). Is there anything I need to do before I graduate?

Yes. J.D. students considering public service careers are encouraged to discuss their options with a Berkeley Law LRAP Advisor well before graduation. If you are considering applying to Public Service Loan Forgiveness (PSLF) or participating in the LRAP Program, it’s highly encouraged to schedule an appointment before you graduate. In order to participate in the LRAP, you must meet with an LRAP advisor prior to graduation.

How do I know what student loans I’ve borrowed?

If you do not know what type of federal student loans you borrowed while in attendance at UC Berkeley, visit studentaid.gov. To verify any lines of credit that you have, including private student loans, request a copy of your free annual credit report.

What are the policies for students withdrawing?

UC Berkeley has developed a financial aid policy for students who withdraw from school without completing a program. To learn more about this policy, visit the UC Berkeley Office of the Registrar’s webpage and the UC Berkeley Financial Aid Office’s webpage. If you are a financial aid recipient and are considering withdrawing, contact us prior to withdrawing.

How can I estimate what my monthly student loan payments will be after graduation?

If you plan on borrowing federal student loans, it’s a good idea to become familiar with the different repayment options you have. To make your payments more affordable, repayment plans can give you more time to repay your loans or can be based on your income. Use the Department of Education’s Repayment Estimator. On this site, you can either ‘log in’ to view your actual federal student loans, or you can ‘proceed’ to manually enter in estimated loan balances. If you will be using Berkeley’s LRAP program, we strongly encourage you to speak with an LRAP advisor for more information.

How does interest accrue on a federal student loan?

Interest accrues daily on your student loan from the day it’s disbursed until the day your loan balance reaches zero.

Use this simple formula to calculate your daily interest accrual:

Interest rate × current principal balance ÷ number of days in the year = daily interest

source: https://myfedloan.org/help-center/faq/interest-faq.shtml

Am I required to provide my parent’s information when applying for need-based financial aid?

This can vary from student to student and is based on how a few questions are answered throughout the Supplemental Gift Aid survey (SGA). There will be an area on the survey where you can further explain your situation if your answers/survey does not accurately reflect your financial situation. (NOTE: the FAFSA uses different criteria to define ‘independent’, therefore, you may not be required to enter parent information on the FAFSA but will be required to on the SGA.

Am I required to complete both the FAFSA and Supplemental Gift Aid (SGA) survey?

Entering Students:

You are required to complete the FAFSA for federal student loan eligibility. Berkeley Law does not require parent information on the FAFSA.

After you are admitted we encourage you to submit the supplemental gift aid application (SGA) within one month. You can expect to receive an email with instructions on how to submit this supplemental gift aid application. This form will primarily ask about financial obstacles you’ve faced or are facing, which can then be taken into consideration when determining your gift aid offer. Applying early means you have a better chance of receiving gift aid, especially for funding that has a financial need component. While the supplemental gift aid application is optional, there are questions on this application that are independent of financial need and background. We therefore encourage all admitted students to submit the SGA. If you choose not to submit the SGA, the information contained in your admissions application will still be used to determine a gift aid offer, therefore it is not required.

This information is listed on the Entering Student Scholarships & Gift Aid

*The SGA survey is emailed to students within a week of being admitted

Continuing Students:

- You are required to complete the FAFSA for federal student loan eligibility. Parent information on the FAFSA is required only if you are applying for need based Continuing Student Scholarships and under the age of 30. Continuing students do not submit a SGA survey.

Can DACA students who are eligible to complete a DREAM Act application be considered for federal work study?

No. Students must be eligible for Federal Student Aid by completing a FAFSA to be eligible for work study at Berkeley.